Latest News

- Disco Dive: Slot Penuh Warna dari OCTOPLAY yang Gampang Jackpot

- Pendidikan di Indonesia Melahirkan Tokoh-Tokoh Pergerakan

- Tipe Taruhan Togel Online Berikut Ini Mudah Dimenangkan

- Mengapa Slot Dana Jadi Pilihan Aman untuk Deposit Slot?

- Mengungkap Rahasia Link Slot QQ dan Link Slot Gacor Hari Ini

- Kiat-kiat untuk mencegah Kesalahan Umum pada Slot Berbasis Web

- Perbandingan Slot Bet Kecil dan Slot Bet 100: Mana yang Lebih Menguntungkan?

- Basketball Star: Menggunakan Strategi yang Terbukti Efektif untuk Memenangkan Hadiah Besar

- RTP Slot Hari Ini: Pelajari Persentase Kemenangan

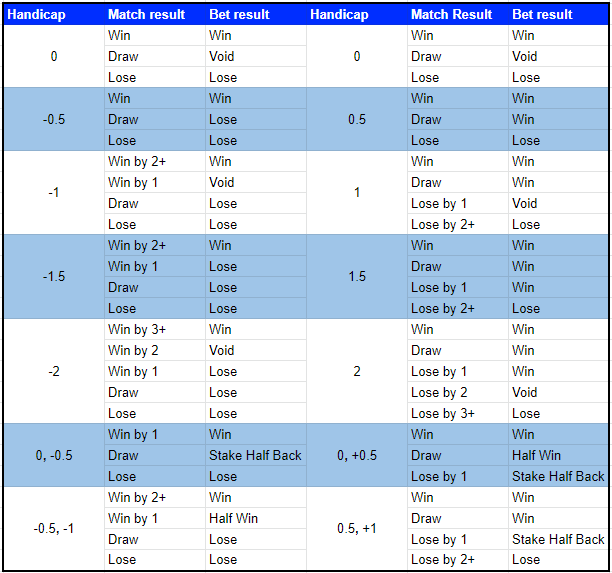

- Judi Bola Parlay: Peluang Emas untuk Menghasilkan Uang

- Permainan Judi Kartu Online: Berikut Fakta Menarik Paling Terbaru

- Kelezatan Rasa Menyelami Kuliner Tradisional Kalimantan